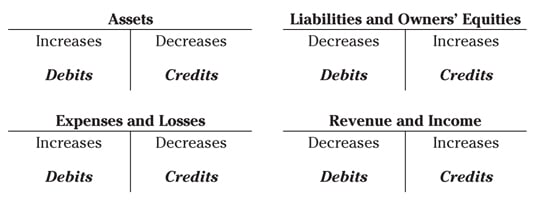

Credits decrease Asset accounts. Debits increase Asset accounts.

Debit And Credit Cheat Sheet Chart Of Debits And Credits Accounting Basics Bookkeeping Business Financial Accounting

A cheat sheet like this is an easy way to remember debits and credits in accounting.

Debit credit cheat sheet. Also you can add a description below the journal entry to help explain the transaction. Apr 13 2017 - debit and credit cheat sheet - Google Search. Debits and Credits Cheat Sheet.

Debit credit in excel template is a useful accounting spreadsheet that lets a company or individual person to record all money related transactions such as payment received as well as expense incurred in a particular period of time. The Cheat Sheet for Debits and Credits by Linda Logan PartnerPresidentFounder of Fiscal Foundations LLC Asset accounts have debit balances. If you are learning the accounting system may be you needs a read and collect.

In accounting there is one equation used quite regularly particularly with regards to financial statements. This is for Personal Use Only. Accounting Cheat Sheet to Credit and Debits Assets.

Because cash is involved in many transactions it is helpful to memorize the following. Whenever cash is received debit Cash. Increases a liability account.

With the knowledge of what happens to the Cash account the journal entry to record the debits and credits is easier. These Journals are then summarized and the debit and credit balances are Posted transferred to the General Ledger Accounts and the amounts are posted to the left side of the. A debit credit cheat sheet is basically a study guide.

The highlighted green on assets and expenses shows an increase in assets and expenses. Third indent and list the credit accounts to make it easy to read. Decreases an asset account.

Benefits of use the debit and credit cheat sheet To study basic accounting double-entry. To help you master this topic and earn your certificate you will also receive lifetime access to our premium debits and credits materials. A decrease on the asset side of the balance sheet is a credit.

An accounts assigned normal balance is on the side where increases go because the increases in any account are usually greater than the decreases. This pdf was carefully put together to summarise all of the key information from the Debits and Credits video on one page. It serves as a guide as much as anything.

Download the Cheat Sheet Effect on values in the debit or credit columns If a value is placed into the credit column of the assets account it will decrease the total value of that account. Debits and Credits Cheat Sheet. Financial effects of revenues and expenses Revenue Asset increase debit or Liability decrease debit Expense Asset decrease credit or Liability increase credit.

Get the debits and credits cheat sheet. Last put the amounts in the appropriate debit or credit column. Our Debits and Credits cheat sheet below will help you to visualise the difference.

These include our visual tutorial flashcards cheat sheet quick tests quick test with coaching and more. Second all the debit accounts go first before all the credit accounts. They need to take into account a number of tax deductions as well as credits to make sure that their tax return is correct and there are no.

When Cash Is Debited and Credited. If the balance sheet entry is a credit then the company must show the salaries expense as a debit on the income statement. The purpose of my cheat sheet is to serve as an aid for those needing help in determining how to record the debits and credits for a transaction.

Data of the debit credit in excel template can be used then in making annual financial statements. The red shows a decrease in assets and expenses but an increase in liabilities capital and income. This sheet will be help during the.

Decreases a liability account. Whenever cash is paid out credit Cash. My Cheat Sheet Table begins by illustrating that source documents such as sales invoices and checks are analyzed and then recorded in Journals using debits and credits.

Accountants record increases in asset expense and owners drawing accounts on the debit side and they record increases in liability revenue and owners capital accounts on the credit side. Increases an asset account. Feel free to print annotate and add it to your notes.

It is a condensed version or summary of what a student in an accounting class needs to know about debits and credits at the appropriate level. Actually the cheat sheet users are mostly accounting students. Debit Credit Credit Credit Credit GL 1000 GL 2000 GL 3000 GL 4000 GL 5000 6000 7000 Debit Credit Cheat Sheet Use this spreadsheet to determine when to debit and when to credit an account Asset Liability Equity Income Expense Debit.

Liabilities are debts that a business or entity has incurred during the covered period including mortgage. Decreases an expense account. Increases an expense account.

Highlighted green on Liabilities Capital and income show a decrease. Apr 13 2017 - debit and credit cheat sheet - Google Search. Use the following figure for credit and debit basics.

Debit And Credit Cheat Sheet General Ledger Debits Credits Accounting For Dummies Accounting Student Accounting Classes Bookkeeping Business

Debits And Credits Normal Balances Permanent Temporary Accounts Accountingcoach

Chapter 9 2 Double Entry Accounting Accounting Debits Credits Accounting Classes Learn Accounting Accounting And Finance

Accounting Ledger Accounting For Dummies Accounting Student Accounting Classes Bookkeeping Business

Accounting Basics Accounting Basics Bookkeeping Business Financial Accounting