Formula to calculate Direct Material Cost Variance. Cost of raw material 20000.

Calculation Of Overhead Absorption Rate Formula Methods Solved Example

3 Add up all the direct costs associated with the production process.

Direct materials cost formula. Once the cost of raw materials used in a particular period has been ascertained and the cost of direct labor and direct expenses is known. The total direct cost of the production process will be calculated by adding up all the direct costs of the production process. The steel included in an automobile.

Rate per Unit of Production Method 7. For example say that a company had 3000 worth of flour stock at the beginning of the year bought 10000 worth of flour during the year and has 2000 worth of flour remaining at year end. There are different types of discounts.

The direct cost margin is calculated by taking the difference between the revenue generated by the sale of goods or services and the sum of all direct costs associated with the production of those. Calculate the Expected Cost. The formula of direct materials yield variance is given below.

The answer is 45000. Actual cost actual quantity actual price It could be done quarterly or annually perform too often will be time-consuming. Throughput is sales minus all totally variable expenses.

See also direct materials mix variance. It is the standard cost of the actual quantity. Direct material yield variance Standard output Standard cost Actual output Standard cost.

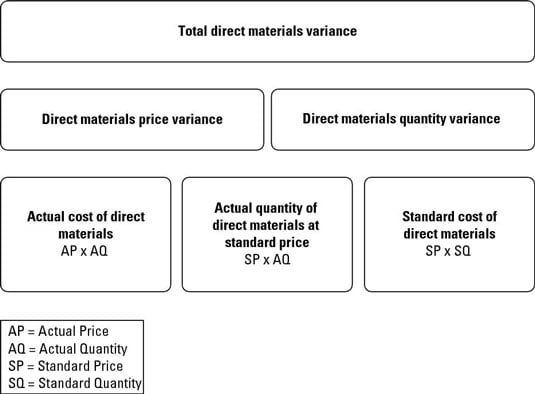

The following chart depicts the divisions of Direct Material Cost Variances very clearly. The calculation for this example is 5000 minus 10000 plus 50000. Examples of direct materials are.

Direct material percentage rate is. It would be easy to simply compare each row of data in terms of cost and assume this was the variance. Cost of consumable supplies 8000.

Machine Hour Rate Method 6. MCV SQx SP -AQxAP Where MCV Material Cost Variance. To calculate direct materials add beginning direct materials to direct materials purchases and subtract ending direct materials.

The formula for this variance is. The following formula is used to calculate Direct Material Cost Variance. Cost of labor 10000.

To compute the cost of direct materials put into production just multiply the quantities for Beginning Inputs and Ending by the 2 cost per unit. The formula for product cost can be derived by adding direct material cost direct labor cost and manufacturing overhead cost. Direct materials yield variance.

It includes the cost incurred by the company to acquire the raw material required for the production of goods. Under this method direct material is the basis for absorption. Direct Material Price Variance is the difference between the actual cost of direct material and the standard cost of quantity purchased or consumed.

Direct Material Cost Method. Rather they are directly allocated to operating departments using some appropriate allocation base. Your calculation reveals that you put 2100 gallons into production for a total cost of 4200.

SQ Standard Quantity for Actual Output. Standard quantity of material allowed for production actual quantity used standard price per unit of material. The timber used to construct a house.

Subtract the value of inventory from the beginning of the year from the value of inventory at the end of the year and then add the total cost of goods sold. Expected Cost Actual quantity Standard Cost. Rate Examples Formula and Methods Method 1.

The prime cost can be calculated by simply adding up the three figures. The direct method is considered the most simple method of allocating the cost of service departments to operating departmentsUnder this method the costs incurred by service departments are not allocated to each other. Cost of machinery 50000.

Calculate total direct materials inventory cost for the year. You have to do similar computations for every type of direct material needed to make products. There are different types of indirect taxes which are included in the invoice that is payable to the seller by the buyer of the goods.

Calculation of Direct Material Cost you can do using below formula as Direct Material Cost Formula SQ SP. The direct material cost is one of the few variable costs involved in the production process. As such it is used in the derivation of throughput from production processes.

SP Standard Price. The direct material cost variances including material price variance material usage variance material mix variance and material yield variance. The company needs to calculate the actual direct material cost.

The total of a products direct costs is called the prime cost. Mathematically it is represented as Product Cost Direct Material Cost Direct Labor Cost Manufacturing Overhead Cost. Prime Cost Percentage Method 4.

Direct Labour Hour Method 5. Standard quantity of material allowed for production actual quantity used standard price per unit of material. The table shows output for one month 1 unit of production is 1 teddy bear and the direct material is the fabric required to make the teddy bears.

So these costs also form part of the direct cost of the company.

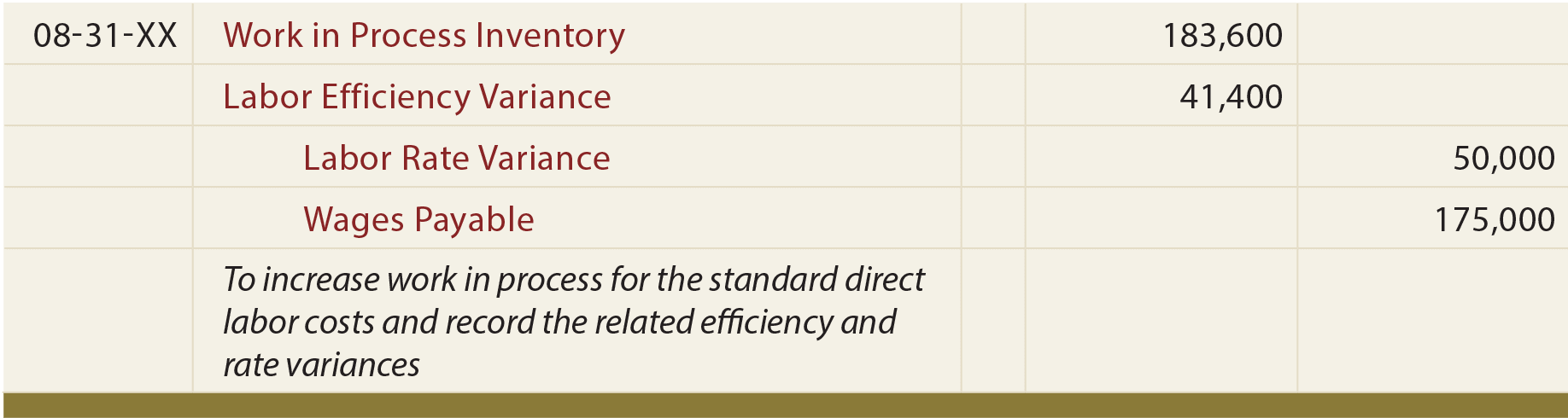

Direct Labor Efficiency Variance is the measure of difference between the standard cost of actual number of direct labor hours utilized during a period and the standard hours of direct labor for the level of output achieved. The variance is sometimes referred to as the direct labor usage variance or the direct labor quantity variance.

Variance Analysis Principlesofaccounting Com

Direct labor price variance SR AR x AH To get the direct labor quantity variance also known as the direct labor efficiency variance multiply the standard rate SR by the difference between total standard hours SH and the actual hours worked AH.

Direct labor efficiency variance. Direct labor efficiency variance actual labor hours budgeted labor hours standard labor rate. Its most often used in manufacturing where its. The labor efficiency variance measures the ability to utilize labor in accordance with expectations.

Standard costing and variance analysis calculators Show your love for us by sharing our contents. A D V E R T I S E M E N T. No variance is more closely watched by management since it is widely believed that increasing the productivity of direct labor time is vital to reducing costs.

Direct labor efficiency variance measures the cost of the difference between the expected number of labor hours required for the operations and the actual number of labor hours required for the operations. If workers manufacture a certain number of units in an amount of time that is less than the amount of time allowed by standards for that number of units the variance is known as favorable direct labor efficiency variance. 33 hours of direct labor 20 hours of standard labor x 60hour 780 The efficiency variance is 780.

One Comment on Direct labor efficiency variance calculator. A favorable labor rate variance suggests cost efficient employment of direct labor by the organization. An unfavorable direct labor efficiency variance indicates that actual hours exceeded standard hours.

The formula for direct labor efficiency variance is. Actual labor hours used in 2200. The quantity variance for direct labor is generally called direct labor efficiency variance or direct labor usage variance.

AH actual hours SH standard hours and SR standard rate. DL efficiency variance AH - SH x SR. Leave a comment Cancel reply.

Hiring of more unskilled or semi-skilled labor this may adversely impact labor efficiency variance. Too many hours may have been used because of inefficiency on the part of employees excessive coffee breaks machine down-time inadequate materials or materials of poor quality that required excessive rework. Direct labor efficiency variance 2200-2000 40 200 40.

Thank you so much for the information. Calculating the Direct Labor Rate Variance and the Direct Labor Efficiency Variance Guillermos Oil and Lube Company is a service company that offers oil changes and lubrication for automobiles and light trucks. Direct labor efficiency variance also called direct labor usage variance is the difference between the standard cost of standard direct labor hours allowed for actual production and the standard cost of labor hours actually used in production.

This variance measures the productivity of labor time. The standard direct labor rate and. Write down the important data from question.

Note that this is a positive number so you have unfavorable variance. 600 units 3 hours 1800 hours. The labor efficiency variance measures the ability to utilize labor in accordance with expectations.

A D V E R T I S E M E N T. Standard labor hour allowed 2000. The direct labor efficiency variance is one of the main standard costing variances and results from the difference between the standard quantity and the actual quantity of labor used by a business during production.

The variance is useful for spotlighting those areas in the production process that are using more labor hours than anticipated. On average Guillermo has found that a typical oil change takes 24 minutes and 62 quarts of oil are used. This is the same as the product of.

Reasons for a favorable labor rate variance may include. This variance is calculated as the difference between the actual labor hours used to produce an item and the standard amount that should have been used multiplied by the standard labor rate. The actual direct labor rate is not used to compute this variance.

Each unit of its product requires 275 direct labor hours to complete. When you plug this into the formula you get a direct labor efficiency variance. Now put the amounts in the formula.

Labor variance is an accounting measure used to analyze cost rates and efficiencies connected with the compensation expense of employing staff. Like direct material standards direct labor standards also consist of two components quantity and price. The direct labor quantity standard is usually referred to as labor efficiency variance while the price standard is referred to as labor rate variance.

XYZ Company has budgeted its direct labor at a rate of 8 per hour. Direct labor quantity variance SR x SH AH. Direct labor efficiency variance SR AH SH 650 1850 hours 1800 hours 650 50 hours 325 Unfavorable Standard hours allowed to manufacture 600 units.