The Contribution Margin Per Unit Calculator calculates the contribution margin per unit and contribution margin ratio. Contribution margin per unit formula would be Selling price per unit Variable cost per unit 6 2 4 per unit.

Contribution Margin Per Unit Per Unit Selling Price.

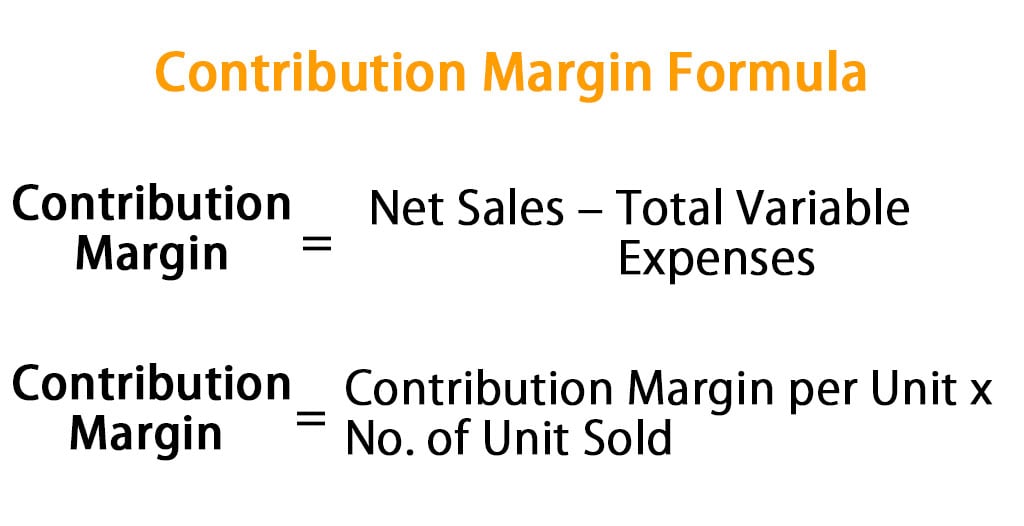

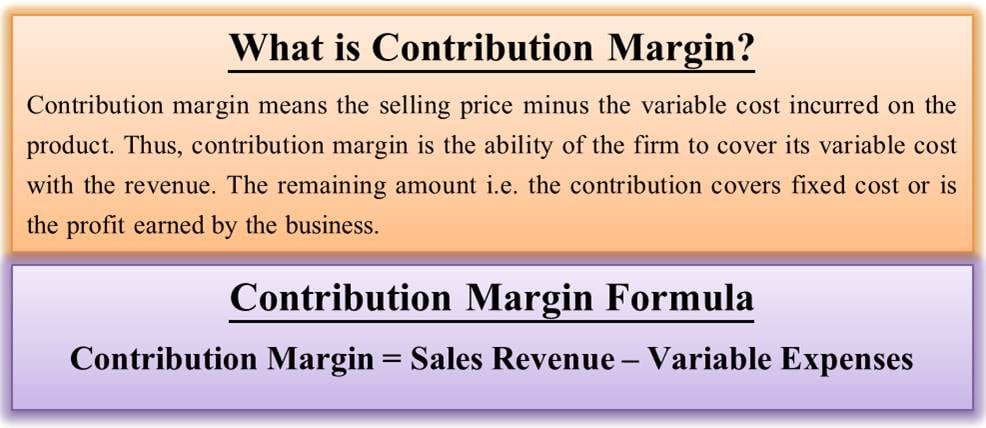

Contribution margin per unit formula. Contribution Contribution per Unit. The contribution margin per unit represents the incremental money generated for each productunit sold after deducting the variable portion of the firms costs and is represented as CMSP-V or Contribution Margin per UnitSales Price per Unit-Variable Cost per Unit. December 13 2020 Unit contribution margin is the remainder after all variable costs associated with a unit of sale are subtracted from the associated revenues.

We know that contribution is the excess of sales over variable cost which is also known as total margin distinguished from profit. Management uses this formula to make production decisions and calculate selling prices in the future. To find the unit contribution margin subtract each stuffed animals selling price from its variable costs.

Contribution ratio would be Contribution Sales 200000 300000 23 6667. In order to calculate their per unit contribution margin we use the formula in Figure 75 to determine that on a per unit basis their contribution margin is. As unit contribution margin formula Sales per unit Total Variable costs per unit.

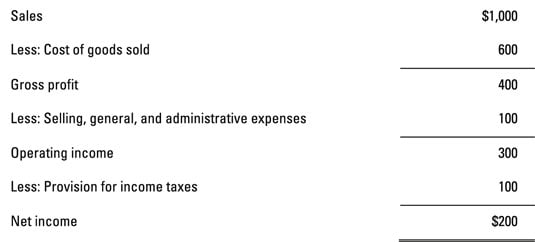

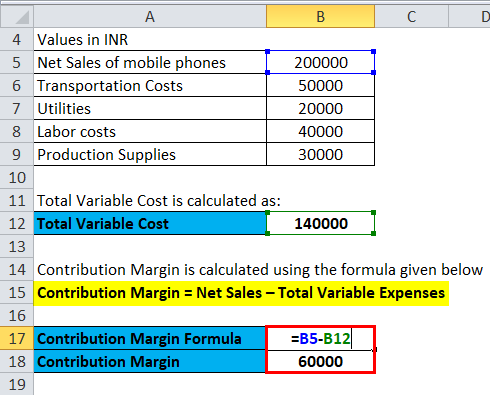

Break-Even for Multiple Products Old Game 8000 units Per Unit New Game 4500 units Per Unit Sales 100000 1250 67500 1500 Less. Contribution Margin Net Sales Variable Costs Contribution Margin Formula Components. Contribution per unit is also known as contribution margin per unit.

However if there are many. The contribution margin formula is calculated by subtracting total variable costs from net sales revenue. Contribution per unit is a really useful number to have.

The contribution margin per unit is 5 10 50001000. Variable cost per unit is corporate expenses that vary in direct proportion to the quantity of output and The sales price per unit determines the price of sale per product. Variable Costs 72000 900 49500 1100 Contribution Margin 28000 350 18000 400 Less.

The unit contribution margin is 1 per unit. Make sure you know the formula and are confident in calculating it. Contribution Margin Net Sales Total Variable Expenses.

Hicks Manufacturing sells its Blue Jay Model for 1100 and incurs variable costs of 20 per unit. It is useful for establishing the minimum price at which to sell a unit which is the variable cost. Calculate the overall revenue of the product.

To work out the per-unit contribution margin management could either use the formula above and use the sales price per unit and variable cost-per-unit or they could divide the 1000000 contribution margin by the number of units sold. Contribution per unit describes how the sale of one unit affects a companys net income. In other words total contribution may be obtained by multiplying the per unit contribution to the volume of sales.

For example if a business has 10000 of fixed costs and each unit sold generates a contribution margin of 5 the company must sell 2000 units in order to break even. In the above example we calculated contribution per unit by subtracting variable cost per unit from selling price per unit. The basic formula for contribution per unit is total revenue minus total variable costs divided by the total units.

Unit contribution margin Contribution margin Unit sales Here Contribution margin 800 Unit sales 800 units. Thus the calculation of contribution per unit is. Contribution Margin per Unit 35 per unit.

Calculate the unit contribution for each product line to find the margin. When only one product is being sold the concept can also be used to estimate the number of units that must be sold so that a business as a whole can break even. This means that after the variable costs are paid 5 is left over to pay the fixed costs associated with producing this product.

Contribution would be 4 50000 200000. Contribution Margin No. Of Unit Sold Variable Cost per Unit.

Fixed Costs 35000 15000 Net Income Loss 7000 3000 The. Contribution Margin Calculator - calculate contribution margin which is the differences between a companys net sales and variable costs. Total revenues - Total variable costs Total units Contribution per unit.

Break-Even Units Fixed Costs Weighted Average Contribution Margin Per Unit Happy Daze. Contribution Margin per Unit 100 65. Total Contribution Margin is calculated using the formula given below.

Of Unit Sold Sales Price per Unit No. In other words contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost. Accordingly the contribution margin per unit formula is calculated by deducting the per unit variable cost of your product from its per unit selling price.

Openstax CC BY-NC-SA 40. This margin analysis can apply to the sale of either goods or services.

CM ratio is used to calculate break-even point. Which can be calculated using the formula.

Contribution Margin Formula Double Entry Bookkeeping

Contribution margin ratio definition This ratio indicates the percentage of each sales dollar that is available to cover a companys fixed expenses and profit.

Contribution margin ratio formula. To calculate the contribution margin ratio divide the contribution margin by sales. The contribution margin is calculated by subtracting all variable expenses from sales. Here is the formula for contribution margin ratio CM ratio.

Contribution Margin Ratio Contribution margin ratio is the ratio of contribution margin to sales. Join PRO or PRO Plus and Get. Contribution margin ratio is nothing but the percentage of sale for the given contribution margin.

Therefore the contribution margin is shown in dollars and the contribution margin ratio is demonstrated as a percentage. Contribution Margin Net Sales Variable Costs Contribution Margin Formula Components. It can be defined as per unit amount total amount ratio or percentage.

Contribution Margin Calculator - calculate contribution margin which is the differences between a companys net sales and variable costs. Based on the above data Compute for the following. The ratio is calculated by dividing the contribution margin sales minus all variable expenses by sales.

Calculating the contribution margin of a company is a simple process as all you need to do is subtract the total variable costs from the net sales revenue figure of a business. The contribution margin ratio can help companies calculate and set targets for the profit potential of a given product. Margin of safety ratio 2.

Formula or equation of CM ratio is as follows. Contribution Margin Ratio Contribution MarginSales 120000200000 060 or 60. Use the following formula to calculate the contribution margin ratio.

It is calculated by dividing the excess of sales over variable costs with sales. 2200 90 P 244444 Exercise No. Fixed factory overhead Contribution Margin ratio To apply the formula.

Use our online contribution margin ratio calculator to get the output instantly. The contribution margin CM is an accounting concept used in cost-volume-profit analysis to estimate the profitability of a specific product or service. Sales - Variable expenses Sales Contribution margin ratio.

The contribution margin formula is calculated by subtracting total variable costs from net sales revenue. The following formula is used to calculate contribution margin ratio CM ratio. CM Ratio Contribution Margin Sales Above can be modified as contribution margin percentage formulaincremental contributionmargin formula average CPR formula cvp formula unit or segment break even point.

CM Ratio Contribution Margin Sales CM ratio is extensively used in cost-volume profit CVP calculations. Contribution Margin per unit calculator calculates the contribution margin per unit and contribution margin ratio. The variable costs ratio to sales is 60 while the net income percentage to sales is 8.

This means Dobson books company would either have to reduce its fixed expenses by 30000. Alternatively contribution margins can be determined by calculating the contribution margin per unit formula and the contribution ratio. Or increase its sales by 50000.

Enter contribution margin and sales in the below calculator and click calculate to find its contribution margin ratio. See an example in Excel here. This ratio is extensively used in cost volume profit calculations.

Margin of Safety 4. Contribution margin ratio contribution margin sales where contribution margin sales minus variable costs. The total sales revenue of Black Stone Crushing Company was 150000 for the last year.

You can also express the contribution margin as a percentage by using the following formula. Western company break even sales are 528000. Example Calculation of Contribution Margin Ratio CM ratio total revenue cost of goods sold any other variable expenses total revenue.

Ratio dfrac Sales. The fixed and variable expenses data of the last. Heres the Contribution Margin Formula Contribution Margin Net Sales Total Variable Expenses.

Contribution margin ratio is the expression of the contribution margin in terms of a percentage of a price.

Contribution margin ratio when expressed in percentage is known as contribution margin percentage. You can use these same methods to evaluate various product or business lines just group your numbers accordingly.

Contribution Margin Formula Examples Calculation Youtube

Contribution Margin For More video link given below of Playlist link Balance Sheet.

Contribution margin per unit calculator. To find the unit contribution margin subtract each stuffed animals selling price from its variable costs. Of Unit Sold Variable Cost per Unit Total Contribution Margin 10000 units 100 10000 units 65 Total Contribution Margin 1000000 650000 Total Contribution Margin 350000. Contribution per unit describes how the sale of one unit affects a companys net income.

Contribution Margin Per Unit Is Multiplied To Number Of Units Sold To Calculate 1revenue Margin 2variable Margin 3contribution Margin 4divisor Margin 10. Unit Contribution Margin Selling Price per Unit Variable Cost per Unit Alternately the formula for UCM can be expressed as the difference of sales and total variable cost divided by the number of units sold. Divide this number by your revenue per unit to express it as a percentage of revenue.

Accordingly the contribution margin per unit formula is calculated by deducting the per unit variable cost of your product from its per unit selling price. Hence the contribution margin per additional unit of the cupcake will be. To calculate Contribution Margin per Unit you need Variable Cost per Unit V and Sales Price per Unit SP.

Contribution Margin Per Unit. If Variable Cost Is 50000 And Fixed Cost Is 30000 Then Operating Income Would Be 180000 2160000 316000 420000 11. It can be computed by either dividing contribution margin per unit by the sales revenue per unit or total contribution margin by total sales revenue for a specific period.

Contribution margin as a percentage of sales revenue. It tells us what percentage the contribution margin of sales revenue is. Contribution margin per unit on this gadget equals 60 100 40 60.

Of Unit Sold Sales Price per Unit No. The basic formula for contribution per unit is total revenue minus total variable costs divided by the total units. The contribution margin per unit represents the incremental money generated for each productunit sold after deducting the variable portion of the firms costs is calculated using Contribution Margin per UnitSales Price per Unit-Variable Cost per Unit.

20 10 10 It simply means that by selling this cupcake the net income or profit increases by 10. Find Contribution Margin Per Unit Subtract your total cost per unit from your revenue per unit to get your contribution margin per unit. Use our online contribution margin ratio calculator to get the output instantly.

Contribution Margin Calculator - calculate contribution margin which is the differences between a companys net sales and variable costs. Contribution Margin Per Unit Per Unit Selling Price. An important point to be noted here is that fixed costs are not considered while evaluating the contribution margin per unit.

The Contribution Margin Per Unit Calculator calculates the contribution margin per unit and contribution margin ratio. In other words contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost. Calculate the unit contribution for each product line to find the margin.

Its also common for management to calculate the contribution margin on a per unit basis. Calculate the overall revenue of the product. Which can be calculated using the formula.

This metric is typically used to calculate the break even point of a production process and set the pricing of a product. To calculate the contribution per unit summarize all revenue for the product in question and subtract all variable expenses from these revenues to arrive at the total contribution margin and then divide by the number of units produced or sold to arrive at the contribution per unit. Contribution Margin No.

Online Contribution Margin Calculator. This formula shows how much each unit sold contributes to fixed costs after variable costs have been paid. Mathematically it is represented as Unit Contribution Margin Sales Total Variable Cost No.

In the example dividing the margin of 170000 by the 105000 shirts you produced gives you a unit margin of 162 per shirt. Contribution margin per unit Sales price per unit Variable costs per unit Say a company sells a single gadget for 100 and the variable cost of making the gadget is 40. How to calculate contribution Margin from Balance Sheet.

With our tool you need to enter the respective value for Variable Cost per Unit and Sales Price per Unit and hit the calculate button. To calculate your per-unit contribution margin divide the total margin by the number of units produced. Thus the calculation of contribution per unit is.

Contribution per unit is also known as contribution margin per unit. Therefore selling the gadget increases net income by 60. The ratio of contribution margin to sales revenue.

Enter contribution margin and sales in the below calculator and click calculate to find its contribution margin ratio. Contribution margin ratio is nothing but the percentage of sale for the given contribution margin.

It is helpful in many making many important business decisions. What are Variable Costs.

What Is Contribution Margin How To Find Formula Example Efm

For example think of a situation in which a business manager determines that a particular product has a 25 contribution margin which is below that of companys other products.

Example of contribution margin. How Is the Contribution Margin Ratio Different. Net Sales of 450000 minus the variable product costs of 130000 and the variable expenses of 30000 for a Contribution Margin of 450000-130000-30000 290000. Total contribution margin Contribution margin per unit Unit sales 30 200000 6000000.

The variable cost per unit is 80. Profit and Loss as Contribution minus Fixed Costs. Heres an example of how to solve for contribution margin.

Contribution margin Sales revenue Variable expenses 10000 4000 1000 10000 5000 5000. As a result the contribution margin for each product sold is 60 or in totality for all units is 3M having a contribution margin ratio of60 or 60. Variable costs are costs that change in a company with an increase in production.

Contribution margin is a way of modeling the profitability of different production levels based on variable unit costs. Examples of variable costs include the cost of raw materials cost of labour shipping etc. Breakeven point in units Fixed costsContribution margin per unit 240000030 80000 units.

In the above CD example the contribution ratio is. The contribution margin sometimes used as a ratio is the difference between a companys total sales revenue and variable costs. 325 x 100 25.

The second element of the contribution margin formula is the variable costs. For example if the price is 10 and the unit variable cost is 2 then the unit contribution margin is 8 and the contribution margin ratio is 810 80. The contribution margin is.

For an example of contribution margin take Company XYZ which receives 10000 in revenue for each widget it produces while variable costs for the widget is 6000. It represents the incremental money generated for each productunit sold after deducting the variable portion of the firms. Product B is contributing more for covering fixed expenses and generating profit because its contribution margin ratio is higher than product A.

In other words the contribution margin equals the amount that sales exceed variable costs. The amount thats left over is the combination of fixed expenses and profit. The contribution margin is the difference between sales and variable costs.

Contribution margin is an important cost accounting concept. Contribution margin can be thought of as the fraction of sales that contributes to the offset of fixed costs. The variable cost per unit includes direct material expense labor expense and variable overhead cost.

The selling price per unit is 100 incurring variable manufacturing costs of 30 and variable sellingadministrative expenses of 10. For the calculation of Contribution margin the firm refers to its net sales and total variable expenses. If a product sells for 100 and its variable cost is 35 then the products contribution margin is 65.

The Contribution Margin Ratio is 644 290000 divided by 450000. For example a refrigerator factory that is producing 10000 units a month has a variable cost for one more unit of 300 with a sales price of 1200. The contribution margin differs substantially between different trades.

The use of equation to calculate contribution margin figure is just for explaining the concept. This is used to make production decisions. Sells a product for 200.

To generate this as a. Fixed costs are the ones that dont change with the activity level whereas the variable costs change with the change in activity levelContribution margin is. Product As contribution margin ratio is 042 or 42 where as product Bs contribution margin ratio is 05 or 50.

Example of Contribution Margin Suppose ABC Ltd. It is done like this. Breakeven point in dollars Breakeven point in units Sales price 80000 80 6400000.

Contribution margin when selling service. The companys Contribution Margin is. Net operating income Contribution margin Fixed expenses 5000 2000 500 5000 2500 2500.

You can also calculate a percentage which is then called the contribution ratio. Contribution margin and target profit. It refers to the amount left over after deducting from the revenue or sales the direct and indirect variable costs incurred in earning that revenue or sales.

Contribution margin x 100 sales price. This is the sales amount that can be used to or contributed to pay off fixed costs. So if the price of your product is 25 and the unit variable cost is 5 the units contribution margin is 20.

Read how you can act on a low Gross Profit - another name for contribution margin. The contribution margin can be stated on a gross or per-unit basis.