In accounting depreciation is referred to as the cost of a tangible asset allocated over the periods of its useful life which is treated as a companys expense. Useful Life of Equipment.

Depreciation Chart As Per Companies Act Basics Depreciation Chart

Of course both useful life and salvage value cannot be known at the time and it is often the case than one or the other or both need to be revised during the lifetime of an asset.

Depreciation useful life chart. Although they may last longer than other assets even fixed assets eventually get old and need replacing. Although you may need to pay all of the expense up-front you cannot deduct all of that expense from your taxes in one go. First add the number of useful years together to get the denominator 1234515.

Because your business should match its expenses with its. Under the Income Tax Act and in companies Act depreciation is provided on the Fixed Assets. Useful life does not refer to the length of.

This is the same moment up to which directly attributable costs can be recognised as a part of the cost of PPE. Substituted for cost less its residual value. An asset is depreciated over its useful life which is the period over which an asset is expected to be available for use by the entity IAS 166.

The useful life is defined as the period of time over which the equipment will depreciate. The MACRS Asset Life table is derived from Revenue Procedure 87-56 1987-2 CB 674. This option will be helpful in comparing different expected values of the above-mentioned factors.

Depreciation is the systematic allocation of the depreciable amount of an asset over. The same amount is depreciated each year that the asset has a useful life. Depreciation Recovery Periods Useful Life for Business Equipment Cost Basis of the Asset The cost basis for an asset is any costs incurred so that you can start using it in your business.

Depreciation period useful life Depreciation starts when the asset is in the location and condition necessary for it to be capable of operating in the manner intended by management. If the useful life for your equipment is known to be different than the general useful life applied please let the Capital Asset Accounting team know on the tag report. As you can see the straight line basis reduces the value of the asses evenly.

In new companies act depreciation is allowed on the basis of the useful life of assets and residual value. Depreciation Useful Life Chart The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168 a of the irc or the alternative depreciation system provided in section 168 g. The depreciable amount of an asset is the cost of an asset or other amount.

The chart below shows the difference between straight line depreciation and reducing balance depreciation. Which an asset is expected to be available for use by an entity or the number of production. This method is.

Learn more about useful life and depreciation including fixed asset depreciation accounting and the estimated useful life of assets. Depreciation Guide CategoryItem Ann Dep Useful Years APPLIANCES MAJOR Air Conditioners - Central 67 15 Air Conditioners - Window 100 10 Dehumidifier 100 10 Dishwasher 125 8 Dryer - Electric 83 12 Dryer - Gas 77 13 Fans - Attic 67 15 Fans - Exhaust 50 20. This includes but is not limited to sales tax installation charges delivery charges and any other related costs.

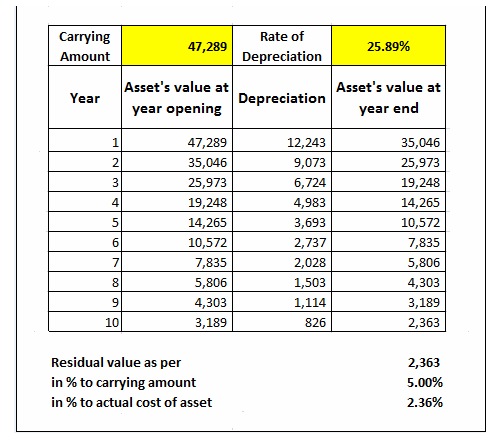

The calculator will give you the detailed chart containing depreciation amount for each year of the useful life of the asset until the last year of expected useful life of the asset. Then depreciate 515 of the assets cost the first year 415 the second year etc. This chart represents the general useful life applied to assets in a specific subaccount range.

Any asset that has a lifespan of more than a year is called a fixed asset. There is also an option to add to the table. The useful life of computer software leased under a lease agreement entered into after March 12 2004 to a tax-exempt organization governmental unit or foreign person or entity other than a partnership cannot be less than 125 of the lease term.

UNLESS NOTED Basketball Courts 15 25 Built Improvements playgroundssite furniture 20 20 Catch Basin 40 40 Cold Water and Sewer Lines 40 40 Compactors 15 15 DHWSupplyReturn 30 30 Dumpsters 10 10 Dumpster Enclosures 10 10 Fence only. Under Income Tax Depreciation is provided on the basis of percentage of the written down value WDV of fixed assets. A depreciation estimate is calculated based on the chosen method of depreciation and on estimates of an assets useful life and salvage value.

The useful life of an asset is the period over. The value of the asset depreciates over time and you can write off a certain amount as an expense against taxes every year. The useful life of an asset is an estimation of the length of time the asset can reasonably be used to generate income and be of benefit to the company.

Tax-exempt use property subject to a lease. The macrs asset life table is derived from revenue procedure 87 56 1987 2 cb 674. Straight line depreciation is the most common method used in calculating the depreciation of a fixed asset.

Use this table to determine an assets class based on the assets activity type or description. The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168 a of the IRC or the alternative depreciation system provided in section 168 g. If you can depreciate the cost of computer software use the straight line method over a useful life of 36 months.

All businesses use equipment furnishings and vehicles that last more than a year. Depreciation expenses are subtracted from the companys revenue as a part of the net income calculations. Depreciation means that you write off the value of the asset over its expected useful life.

Useful Life of Equipment. EXPECTED USEFUL LIFE TABLE SITE SYSTEMS FAMILY ELDERLY ACTION REPLACE 50 long-lived systems CONSTR.