Any disequilibrium in the balance of payments would be automatically corrected by a change in the exchange rate. There is still a risk that the govt.

Exchange Rates Currency Systems Economics Tutor2u

With a fixed exchange rate the central bank must intervene to defend the fixed rate by buying domestic currency.

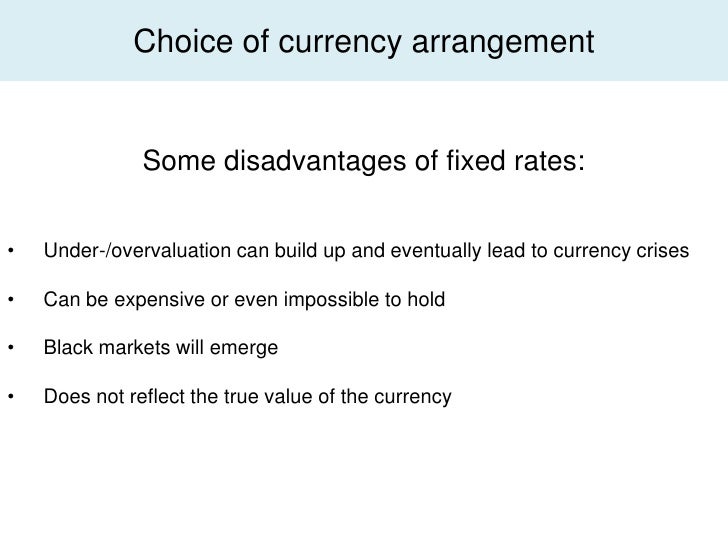

Fixed exchange rate disadvantages. A fixed exchange rate is typically used to. Preventing adjustments for currencies that become under- or over-valued. Therefore such a system.

Join at the. A fixed exchange rate does not automatically correct a balance of payments disequilibrium. A government typically fixes its exchange rate because its currencys value had been fluctuating too wildly.

Disadvantages of fixed exchange rates The economy may be unable to respond to shocks - a fixed exchange rate means that there may be no mechanism for the government to respond rapidly to balance of payments crises. There are advantages and disadvantages to using a fixed exchange rate system. Fixed exchange rates require the Central Banks to set up trading desks and currency boards to manage the currency actively on a daily basis.

Ii Adequacy of Foreign Exchange Reserves. This restrains domestic economic policies from focusing on unemployment and inflation. A metallic standard is considered to promote price stability.

For example if a country suffers. Fixed exchange rate pros and cons. The main disadvantage of fixed exchange rate is that it will cause problems to economy to speculation attacks.

Before looking at these disadvantages question some of the advantages of fixed exchange rates. A fixed exchange rate can make a countrys currency a target for speculators. A stable system allows importers exporters and investors.

Requiring a large pool of reserves to support the currency if it comes under pressure. The disadvantages of a fixed exchange rate include. To maintain a fixed level of the exchange rate may conflict with other.

Disadvantages of Fixed Exchange Rates Developing economies often use a fixed-rate system to limit speculation and provide a stable system. Limiting the extent to which central banks can adjust interest rates for economic growth. Floating exchange rates have the following advantages.

For example if the price. Because price stability leads to. In this article we will discuss about the advantages and disadvantages of floating exchange rates.

A fixed exchange rate sometimes called a pegged exchange rate is a type of exchange rate regime in which a currencys value is fixed or pegged by a monetary authority against the value of another currency a basket of other currencies or another measure of value such as gold. In a fixed exchange rate it is difficult to respond to temporary shocks. Disadvantages A fixed exchange rate can be expensive to maintain.

It may make each country and its MNCs more vulnerable to economic conditions in other countries. Iii Internal Objectives of Growth. Since all these conditions are absent today the smooth functioning of the fixed exchange rate.

Requiring a large pool of reserves to support the currency if it comes under pressure. Disadvantages of fixed exchange rates 1. A country must have enough foreign exchange reserves to manage its currencys value.

Freely Floating Exchange Rate System. Fixed exchange rates are not permanently fixed or rigid. Advantage of Floating Exchange Rates.

Disadvantages of Fixed Exchange Rates 1. A pegged rate or fixed exchange rate can keep a countrys exchange rate low helping with exports. For the effectiveness of a stable exchange rate the necessary condition is.

The disadvantages of a fixed exchange rate include. The resulting contraction of the domestic money supply and increase in interest rates reinforces the initial contraction in domestic output With a flexible exchange rate the tendency towards a balance of payments deficit reduces the value of domestic currency boosting. In fact uncertainty and hence speculative activities tend to get a boost even under the.

Preventing adjustments for currencies that become under- or over-valued. Disadvantages of Fixed Exchange Rate System. Will alter the value of a specific currency.

In case of a floating exchange rate the central bank does not have to take so many efforts. Limiting the extent to which central banks can adjust interest rates for economic growth. Conflict with other macroeconomic objectives.

Conversely pegged rates can sometimes lead to higher long-term inflation. A fixed system forces a government to correct the disequilibrium by raising interest rates and lowering domestic demand. By pegging the currency to a more stable one the government hopes to bring stability.

Questionable economic stability and prosperity. There are benefits and risks to using a fixed exchange rate system.