You also use cost accounting to determine a price for your product or service that will allow you to earn a reasonable profit. This is a system of tables and reports with a convenient daily analysis of cash flows profits and losses payments to suppliers and buyers cost of production etc.

Accounting Formulas Chart Of Accounts Dr Cr Rule

Schedule Variance SV Earned Value EV Planned Value PV Schedule Performance Index SPI EV PV.

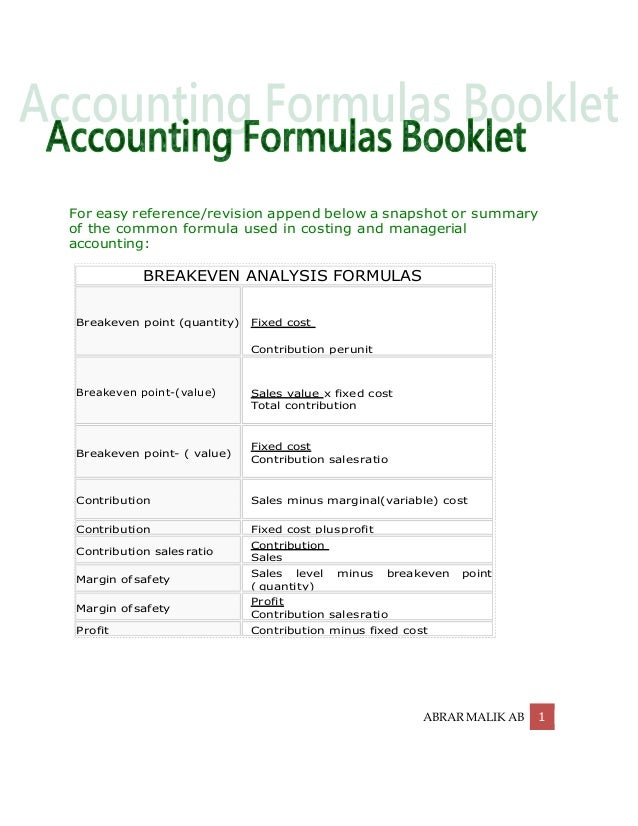

Cost and management accounting formulas. Accounting 303 covers many aspects of cost accounting so this is a formula sheet with the information in one place for ratios and calculations. Materials price usage variance Actual quantity used Actual price Actual quantity used Standard price materials quantity usage variance formula. Cost and Management Accounting 2JNU OLE 11 Introduction Management accounting can be viewed as Management-oriented Accounting.

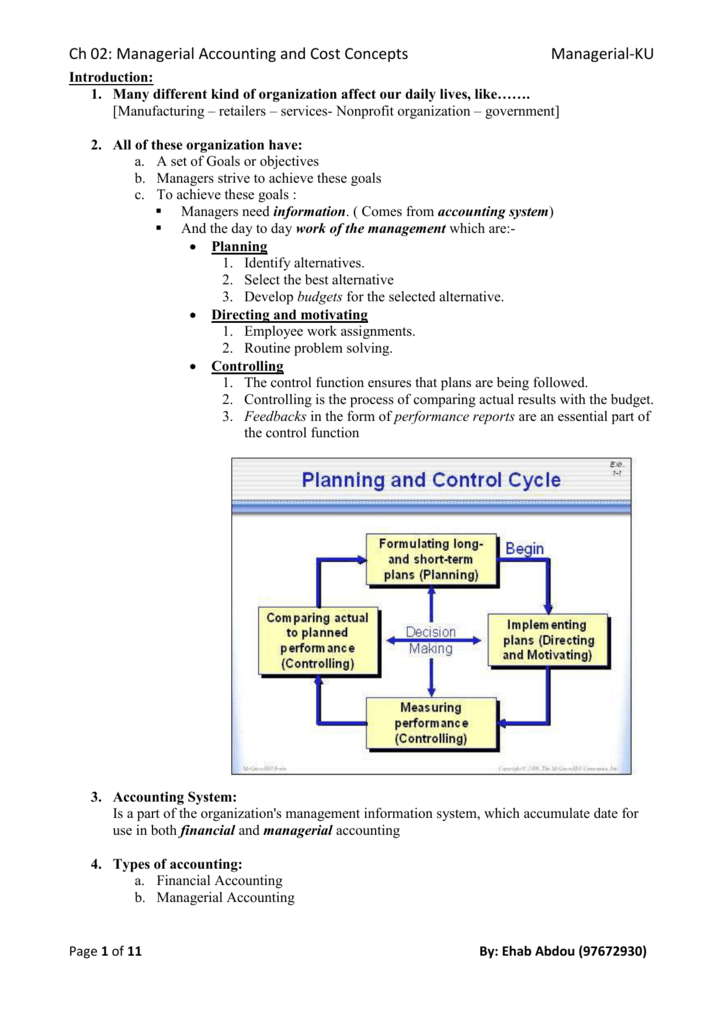

Cost of Goods Sold. It shows how the accounting function. Understand role of Financial Accounting Cost.

Modern Management of Costs and Quality 171 Global Competition 172 Kaizen 173 Lean Manufacturing 174 Just in Time Inventory 175 Total Quality Management. Factory cost Direct material Direct labour Factory overhead. If you know sales price variable cost per unit volume and fixed costs this formula will predict your net income.

Cost Variance CV Earned Value EV Actual Cost AC Cost Performance Index CPI EV AC. Accounting students can take help from Video lectures handouts helping materials assignments solution On-line Quizzes GDB Past Papers books and Solved problems. Materials purchase price variance Actual quantity purchased Actual price Actual quantity purchased Standard price Materials price usage variance formula.

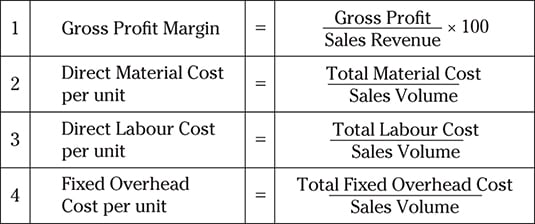

B Debtors or receivables Turnover RatioVelocity. The margin reveals the aggregate earnings from the sale of all products and services but before any selling and administrative. These issues can then be investigated to see if remedial action should be taken with the intent of enhancing profits.

1 Sales Total cost Profit Variable cost Fixed cost Profit 2 Total Cost Variable cost Fixed cost 3 Variable cost It changes directly in proportion with volume 4 Variable cost Ratio Variable cost Sales 100 5 Sales Variable cost Fixed cost Profit 6 Contribution Sales PV Ratio. Basically it is the study of managerial aspect of financial accounting accounting in relation to management function. Managerial and Cost Accounting 7 Contents 16.

Understand the concept of Financial Accounting Cost Accounting and Management Accounting. The total cost formula is used to derive the combined variable and fixed costs of a batch of goods or services. Current Assets Movement Asset Management Ratios a Inventory Stock Turnover Ratio.

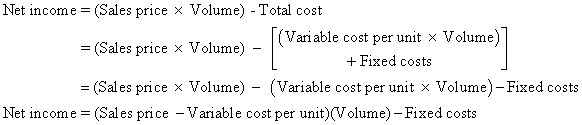

Variable cost per unit is the additional cost of producing a single unit. Formula for Variable Costs Total Variable Cost Total Quantity of Output x Variable Cost Per Unit of Output Variable vs Fixed Costs in Decision-Making Costs incurred by businesses consist of fixed and variable costs. First understand where this formula comes from.

Materials purchase price variance Formula. Consider how production volume affects total costs. Net income Sales price Variable cost per unit Volume Fixed costs.

Cost accounting formulas January 12 2021 Certain cost accounting formulas should be monitored on a regular basis in order to spot spikes or drops in the performance of an organization. Conversion Cost Direct material Factory overhead. Important Formulas--Cost Management.

Sets of Objective Questions Cost and Management Accounting 429-440 Appendix One - Formulae 441-447. Prime cost Direct material consumed Direct labour. Net income Sales price Variable cost per unitVolume Fixed costs First understand where this formula comes from.

Cost-volume-profit CVP analysis helps you understand how changes in volume affect costs and net income. In the following bullet points we note several of the most useful managerial accounting formulas. Familiarize yourself with the most important formulas terms and principles you need to know to apply.

Managerial decisions are made on the basis of management accounting data. This is sales minus the cost of goods sold divided by sales. Learning Objectives After studying this topic you should be able to 1.

The formula is the average fixed cost per unit plus the average variable cost per unit multiplied by the number of units. Example of the Total Cost Formula. Total cost Variable cost per unit x Volume Fixed costs.

The following formulas can be used to find out different costs. Cost accounting is a valuable tool you use to reduce and eliminate costs in a business. Management accounting is designed to represent the actual state of the enterprise business.

Job Costing in Service Not For-Pro Þ t and Governmental Environments 161 The Service Sector 162 Capacity Utilization 17. Average fixed cost Average variable cost x Number of units Total cost.

Estimate The Cost Formula For Maintenance Cost

Ten Managerial Accounting Formulas Dummies

10 Ratios Of Management And Cost Accounting Dummies

Cost And Management Accounting Notes And Formula Cost Accounting Inventory

Cost Accounting Formula S Cost Of Goods Sold Cost Accounting