A calculation used in activity-based costing for determining the costs associated with activities based on particular time-based processes. Divide net sales by gross sales.

Image Result For Cost Volume Profit Analysis Formulas Cost Accounting Fixed Cost College Survival

10 Average fixed cost 3 Average variable cost x 1000 Units 13000 Total cost.

Formulas of cost accounting. Beginning inventory value Purchases of inventory Ending inventory value Cost of goods sold. B Cost accounting is a science and arts both. To reduce and eliminate costs in a business you need to know the formulas that are most often used in cost accounting.

Financial Accounting Cost Accounting and Management Accounting 1 - 22 Study Note 2 Material Control 23-48 Study Note 3 Labor Cost Computation and Control 49-88 Study Note 4 Overheads 89-118 Study Note 5 Methods of Costing-Job Batch and Contract Costing 119-146 Study Note 6. Conversion Cost Direct material Factory overhead. The result should be close to 1.

Materials price usage variance Actual quantity used Actual price Actual quantity used Standard price materials quantity usage variance formula. The first function is to control the cost within the budgetary constraints management has set for a particular product or serviceIt is essential since management allocates limited resources to specific projects or production processes. By the number of goods produced.

Cost pool total Cost driver The result will be a dollar amount that can then be multiplied by the number of products manufactured to obtain a total product cost for that cost pool. Subtract the cost of goods and services from net sales. When you understand and use these foundational formulas youll be able to analyze a products price and increase profits.

Cost Accounting Formulas And Terminologies 1. At the 1000-unit production level the total cost of the production is. Economic costs represent any what-if scenarios.

You multiply your sales per unit by units sold. Financial accounting is primarily concerned with record keeping directed towards the preparation of Profit and Loss Account and Balance Sheet. Materials purchase price variance Formula.

Prime Cost Direct Material Direct Labor2. The breakeven point is the level of sales where your profit is zero. The result as a percentage of net sales should be.

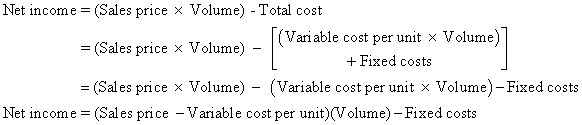

When you subtract your fixed costs from contribution margin the amount left over is your profit. The formula for total cost can be derived by adding the total fixed cost to the total variable cost. It consist its own principles concepts and conventions which may vary from industry to industry.

The breakeven formula is sales minus variable cost minus fixed cost. Accounting 303 covers many aspects of cost accounting so this is a formula sheet with the information in one place for ratios and calculations. Cost accounting formulas Net sales percentage.

An important part of standard cost accounting is a variance analysis which breaks down the variation between actual cost and standard costs into various components volume variation material cost variation labor cost variation etc so managers can understand why costs were different from what was planned and take appropriate action to correct the situation. Mathematically it is represented as Total Cost Total Fixed Cost Total Variable Cost. Example of the Total Cost Formula A company is incurring 10000 of fixed costs to produce 1000 units for an average fixed cost per unit of 10 and its variable cost per unit is 3.

It is the source of all other functions of cost accounting as we can calculate the cost of sales per unit for a particular product. If not the company is losing an. Beginning balance net income net losses dividends ending balance.

Breakeven Formula Profit 0 sales variable costs fixed costs Target Net. It provides information regarding the. You can calculate accounting cost by subtracting your expenses from your revenue.

Cost accounting is a practice of cost control which is as follows-a Cost accounting is a branch of systematic knowledge that is a discipline by itself. The above mentioned is the concept that is elucidated in detail about Accounting Formulas for the Commerce students. Cost Accounting is a branch of accounting and has been developed due to limitations of financial accounting.

Factory cost Direct material Direct labour Factory overhead. Sales Cost of goods sold Gross profit. You can print it out and use it on the proctored.

The following formulas can be used to find out different costs. Materials purchase price variance Actual quantity purchased Actual price Actual quantity purchased Standard price Materials price usage variance formula. Prime cost Direct material consumed Direct labour.

Accounting costs represent anything your business has paid for.

Indirect Cost Calculation And Process About Ala

Ten Managerial Accounting Formulas Dummies

Image Result For Cost Accounting Formula Cheat Sheet Cost Accounting Budgeting Process Financial Management

List Of Accounting Ratios With Formulas Learn Accounting Online